Sharia-Compliant Digital Lending

With global mobility down and no prospects for physical experiences in foreign lands insight, we are taking a virtual trip towards the Global Middle East! Towards Islamic credit markets, and towards yet another exciting opportunity in digital lending!

A Brief Introduction to Sharia-Finance

Islamic finance refers to how businesses and individuals raise capital in accordance with Sharia-law, a set of rules that comply with the Quran, the Sacred Scripture of the Muslim community. Key concepts include the avoidance of riba (usury) and gharar (ambiguity or deception). Money is seen as a representation of value, not an asset in itself, leading to the saying’ money cannot make money.

Therefore, simply lending capital with interest (and therefore for profit) is considered riba – and prohibited under Islamic law.

The concept of risk-sharing must be considered when raising capital in accordance with Sharia law. The Sharia-compliant product uses a bank fee rather than an interest payment structure while keeping product features very similar. Lending activities must happen within a banking framework in which the financial institution shares in the profit and loss of the loan it underwrites. To comply with the risk-sharing approach of Sharia-compliant lending, the Islamic bank may pool investors’ money and assume a share of the profits and losses.

Why Sharia-compliant Digital Lending?

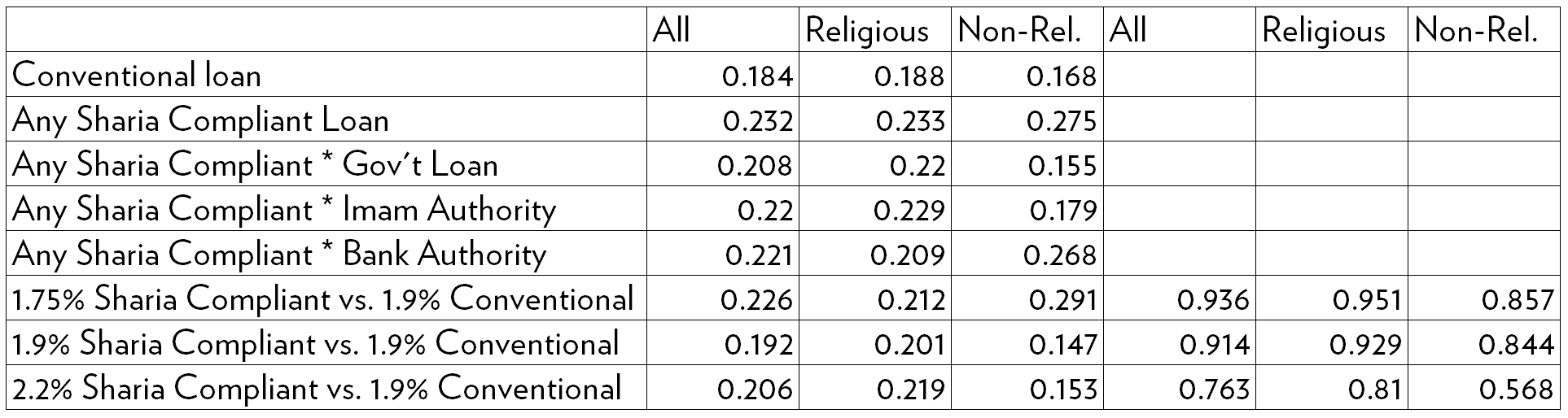

As the Islamic Finance Marketing Experiment 2020 found, consumer preferences for Sharia-compliant lending products over conventional products are relatively un-elastic when it comes to religious borrowers. In a randomized experiment in Jordan, the researchers found that Sharia-compliance increased the application rate for loans from 18% to 22%, which equates to a 10% decrease in interest rates.

Source: Islamic Finance Marketing Experiment 2020

These barriers add to the intrinsic dislike of conventional loans for religious borrowers. The findings suggest that religious considerations are partially responsible for the low utilization rate of household credit in developing countries with a large Muslim-population. High lending rates, an exclusive attitude, complicated procedures, and bureaucratic policies of traditional FIs are common obstacles reported by (M)SME when getting a loan. Muslim-majority countries have a 24% lower participation rate in active borrowing from banks (10.5% versus 7.9%) and a 29% lower rate of having a bank account (40.2% versus 28.6%).

Sharia-compliant digital lending products could not only lower access barriers to Islamic finance, but they could also contribute to mitigating the region’s financing gap, which sits at $335bn for South Asia and $186bn for the Middle East. Digitization could also propel Islamic finance’s growth in general, which is experiencing moderate to sluggish growth (1-2% in the next 2-3 years, S&P Moodys 2020).

Global investments in Islamic economy-relevant companies are already rising. In 2020, VC and other direct investments amounted to 11.8 billion dollars (Dinar Standard , 2019). Almost half of the investment volume, namely, USD 4.9bn, is invested in Islamic Fintech, highlighting the objective of putting technology-enabled finance to use to mitigate the historical slagging growth of Islamic Finance in MEASA.

Notably, the UK accounts for the most registered Islamic Fintech Firms with 27, followed by Malaysia, the UAE, and Indonesia (IFN Islamic Fintechs, 2021). A growing number of more than 120 Islamic fintech firms already offer Sharia-compliant financial products, many of them in the form of digital loans. Examples of Sharia-compliant digital lending platform include MicroLeaP (Malaysia), Dana Syriah (Indonesia), Nusa Kapital (Malaysia)…

Tradition meets Innovation: The Opportunity

According to Dubai International Financial Center (DIFC), Sharia-compliant assets currently represent 25% of banking assets in the Gulf Council Countries (GCC) and 14% of total banking assets in MEASA. Globally, Sharia-compliant AuM are expected to reach $3.8 trillion by 2023, almost doubling their 2020 volume of $2 trillion and growing at a CAGR of 10-12%.

The S&P Islamic Finance Outlook 2020 emphasized the need for inclusive standardization by relevant authorities and stakeholders to sped up Islamic finance advancement. It also hints at the role of Fintechs for supplying the necessary innovations with regards to products and technological infrastructure and for achieving a financial landscape that aligned with ESG objectives.

While market growth remains paced, it is gaining traction: Sharia-compliant digital lending operators in Indonesia have already doubled their Assets under Management between October 2019 and October 2020 (OJK, 2020). As recently as February 2021, the Bank Syariah Indonesia (BSI) was established after consolidating three state-owned banks. BSI has a net worth of $1.4 billion and works on the efficient integration of the three forming banks: Bank BRI Syariah, Bank Syariah Mandiri, and Bank BNI Syariah. The BSI shall allow platforms to better access credit scoring, e-KYC, and digital signature services. It will also integrate customer data from the forming three banks to help fintech companies partnering with BSI to offer services to its customers.

The digital lending market volume in the Middle East (MEA) has recently experienced impressive three-digit annual growth rates with complementing investments in several Arab lending platforms. Excluding Israel from the Middle East region, it is found that 95% of this digital lending volume stems from Debt-based instruments, roughly 5% from equity-based models, and 0.18% from non-investment models such as Waqf (donation)-based crowdlending (CCAF, 2019).

The biggest Sharia-compliant platform for SME lending in gulf countries is beehive, with approximately $170m in facilitated loans in 2020 (as of spring 2021). The platform recently partnered with government entities to roll-out a digital financing platform for micro and small Saudi Arabia enterprises. Across the UAE region, retail investors account for the dominant share of digital loan investments, with 90% against 10% institutional investors.

Another underlying driver is that since 2017, Islam is the fastest-growing religion in the world. It is already the second-largest religion after Christianity, and by 2025, approximately 30% of the global population will be Muslims. Sharia-compliant lending platforms are not only rolling-out products that their customers desire. They are entering an underserved growth market, while also captivating the general socially responsible investors and borrowers due to an emphasis on fair and equitable treatment of counterparties in the financing agreements.

We at Exaloan are excited to see where the market is headed! If you are interested in country-specific details, please contact research@exaloan.com.

References

For an up-to-date picture of all things related to Islamic Fintech, see: https://ifnfintech.com/

Islamic Finance 2020 Report, S&P Moodys: https://www.spglobal.com/_assets/documents/ratings/research/islamic_finance_2020_screen.pdf

Karlan, Dean S. and Osman, Adam and Shammout, Nour Musallam, Increasing Financial Inclusion in the Muslim World: Evidence from an Islamic Finance Marketing Experiment (April 2, 2020). World Bank Policy Research Working Paper No. 9200, Available at SSRN: https://ssrn.com/abstract=3567480

Global Mobility Reports: https://www.google.com/covid19/mobility/

About Exaloan

Exaloan is the leading technology provider for institutional investments in digital loans. Its mission is to close the global funding gap for individuals, entrepreneurs and SMEs by connecting institutional capital with digital lending platforms. By operating a global B2B marketplace, the company opens up digital lending as a new asset class. As an independent agent and validator, Exaloan provides a fully digital investment infrastructure with a standardized risk assessment of each single loan through its Loansweeper™ platform. At the core of its business, Exaloan uses big data and predictive analytics to generate an independent real time credit analysis as well as dedicated insights and reporting for institutional investors, banks, and lending platform partners. Insights cover topics such as sustainability reporting, advanced portfolio analytics, and market research.

Behind Exaloan stands an experienced team with extensive know-how in the areas of quantitative portfolio management, capital markets, machine learning, and software development.